Severity: 8192

Message: Creation of dynamic property CI_URI::$config is deprecated

Filename: core/URI.php

Line Number: 201

Backtrace:

File: /home/jxlutxhi/public_html/index.php

Line: 962

Function: require_once

The foreign exchange (forex) market plays a crucial role in Nigeria’s economy, influencing trade, investment, and the cost of goods and services. Among the key players in Nigeria’s forex landscape are Bureau De Change (BDC) operators, who facilitate the exchange of foreign currencies for both individuals and businesses.

While commercial banks remain the primary institutions for official foreign exchange transactions, many Nigerians and expatriates prefer BDCs due to their convenience, flexibility, and relatively faster transaction times. However, before engaging a BDC operator, it is essential for consumers to understand the benefits, risks, and regulatory framework governing their operations.

This article provides a detailed analysis of Bureau De Change services in Nigeria, highlighting their advantages, regulatory compliance requirements, and critical considerations for consumers. The goal is to equip readers, particularly foreign investors and expatriates, with valuable insights on how to engage with BDCs safely and effectively.

A Bureau De Change (BDC) is a financial institution licensed by the Central Bank of Nigeria (CBN) to provide retail foreign exchange services. BDC operators serve as intermediaries between the forex market and the general public, facilitating the conversion of foreign currencies into naira and vice versa.

BDC operators help bridge the gap between the formal and informal foreign exchange markets, ensuring that individuals and businesses can access foreign currencies with relative ease. Their services include:

The CBN regulates all aspects of BDC operations in Nigeria to ensure compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) laws. To operate legally, a BDC must obtain a license from the CBN and adhere to strict reporting and documentation guidelines.

Regulatory requirements include:

BDCs offer several advantages that make them an attractive choice for individuals and businesses seeking foreign exchange services. Below are the primary benefits:

Despite the availability of foreign exchange services in commercial banks, many Nigerians and expatriates prefer to transact with BDC operators for various reasons. Below are the main factors driving this preference:

Although BDCs offer numerous benefits, it is crucial for consumers to exercise caution and ensure that they engage with licensed and reputable operators. Below are essential factors to consider:

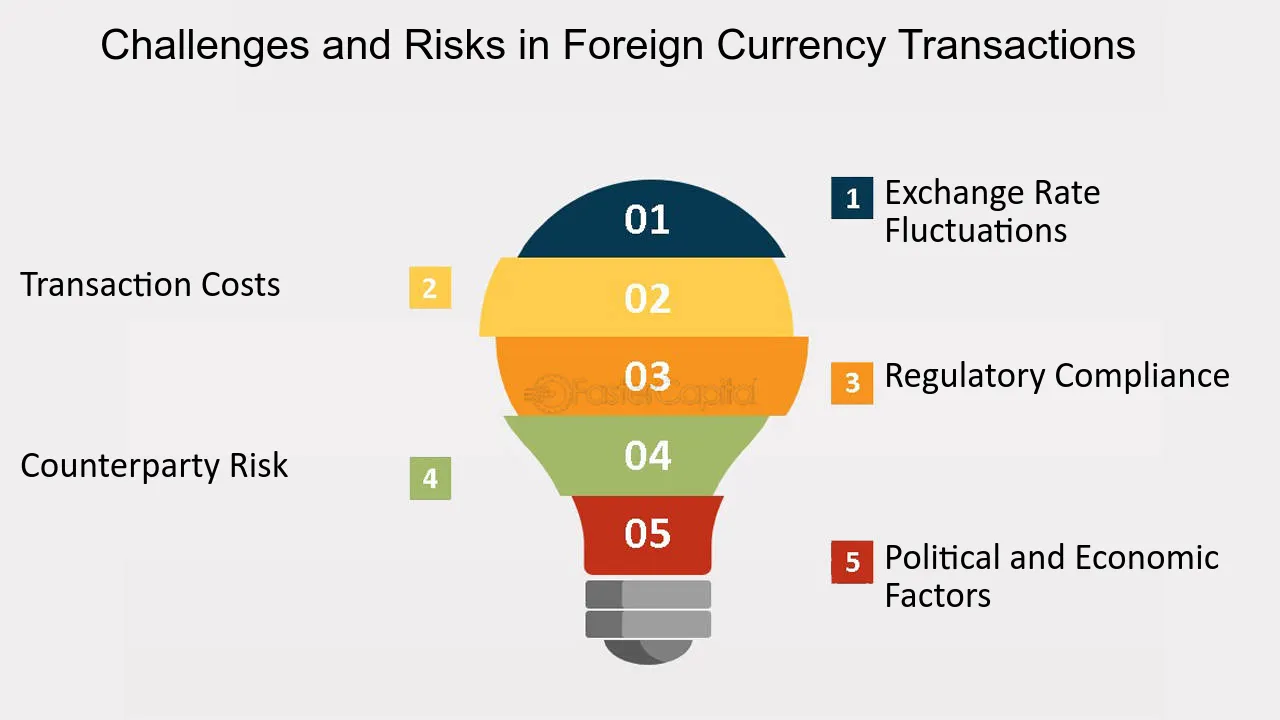

While BDCs offer undeniable advantages, they are not without risks. Below are some challenges and potential pitfalls that consumers should be aware of:.

Fluctuating Exchange Rates – Due to market volatility, exchange rates offered by BDCs may fluctuate significantly, impacting the value of transactions. Exposure to Fraud – Consumers who transact with unauthorized or unlicensed BDC operators risk losing their money to fraudulent schemes. Lack of Legal Recourse – Engaging with unregistered BDCs may limit a consumer’s ability to seek legal recourse in the event of disputes or fraudulent practices.

The CBN plays a critical role in regulating and monitoring the activities of BDCs to maintain stability and prevent illicit financial activities. Recent reforms have aimed to tighten control over the parallel forex market, reduce speculative practices, and ensure compliance with global best practices.

Looking ahead, the CBN is expected to continue its efforts to improve the efficiency of the forex market by promoting transparency, enhancing regulatory oversight, and encouraging the use of digital platforms for forex transactions.

Bureau De Change (BDC) operators play an indispensable role in Nigeria’s forex market by providing accessible, flexible, and convenient foreign exchange services to individuals and businesses. Their ability to offer competitive rates, faster processing times, and reduced bureaucracy has made them the preferred choice for many consumers over commercial banks.

However, engaging with BDCs requires a cautious approach. Verifying the legitimacy of operators, understanding exchange rate dynamics, and adhering to regulatory guidelines are essential steps to ensure safe and secure transactions. As Nigeria’s forex landscape continues to evolve, BDCs are likely to remain pivotal players in facilitating seamless foreign exchange services for both locals and foreign visitors.